Over

the past decades, attempts have been made by traders and researchers aiming to

find a reliable method to predict next action of the securities. As a result we

have a variety of different fundamental and technical analysis methods and many

theories today that really work. For the first pace I want to discuss technical

analysis which is very popular these days.

Technical analysis is a

common method to evaluating securities and determining the next direction of the price through

using chart patterns and mathematical indicators or a combination of both. Many

believe that it is the most reliable way to find out how supply and demand is

going to be changed and what is the latest decision made by market

participants. As a matter of fact a large portion of market traders prefer to

use technical indicators to confirm suggested chart patterns or trading

opportunities.

Sometimes indicators act like they are

completely wrong in predicting or confirming the direction of the market. Is it

because they are absolutely useless or maybe you read them in a wrong way? The

answer is, sometimes the market environment is not suitable for a particular

indicator. That means you can't use a trending indicator in a range market and

vice versa.

Also sometimes different technical indicators

signals conflict and it is not easy to pick the right interpretation between

the possibilities that came out of each indicator. This is because of the

nature of each indicator and this kind of outcome often means "a wrong

setup". You must make sure that no indicator can always show you the right

trading signal. So I think it is a must, for traders to understand the nature

of the indicators and effectively avoid their noises.

However, I am going to introduce the most

common technical indicators and the tips around them.

Moving Averages

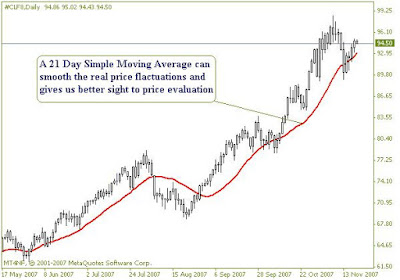

Simple Moving Average (SMA)

A Moving

average simply measure the average price or exchange rate of a security over a

specific

time frame.

For example, 5 day Simple Moving Average is the sum of last 5 days closing/opening price

divided by the number of time periods (5).

Day

|

1

|

2

|

3

|

4

|

5

|

Price

|

6

|

4

|

6

|

8

|

10

|

5 Day SMA

|

-

|

-

|

-

|

-

|

6.8

|

Exponential Moving

Average (EMA)

While

the simple moving average is a lagging indicator, we may find a way to reduce

the lag. To do this, it is better to use another kind of Moving average which

called Exponential Moving Averages. Exponential moving averages reduce the lag

by applying more weight to most recent prices relative to older prices or In

other words it is a weighted simple moving average putting more weight on the

today's closing price.

The weighting applied to the most recent price fully depends

on the period of the moving average. That means if you apply a shorter period

to exponential moving average then you actually placed more weight to the most

recent price. So we should take this into consideration that an exponential

moving average (EMA) react much quicker to most recent price movements.

Also

remember, a 10 day EMA is in fact more than 10 day moving average as it could

include data from the entire life of a security. It can smooth the price

changes and at the same time react to price changes very quickly .Therefore

Exponential Moving Average often identified as the best kind of moving averages

among short term traders in Forex and Futures market day traders.

Today

most of charting applications calculate the Exponential Moving Average

automatically, so you don't actually need to get involved in confusing

mathematical formulas to calculate the EMA price. If you are still curious

about the way an EMA calculate, so in brief:

The

EMA Takes today's price and multiple it by specific percentage as a weighting

factor and then add the result to yesterday's EMA multiplied by 1-EMA

multiplied weighting percentage. The weighted percentages will calculated as

below:

Example: The EMA% for 5 days is 2/ (5 days +1) = 33.3%

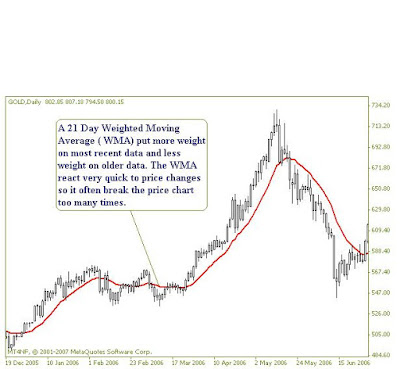

Weighted Moving

Average (WMA)

Weighted

Moving Average is a kind of moving average that put more weight on most recent

data and less weight on older data. A weighted moving average is calculated by

multiplying each of the previous day's data by a weight. To calculate this kind

of moving average we have to put a weight of 1 to oldest data and then 2 for

next data and so on up to the current price. The applying weight is based on

the sum of the number of days in the moving average.

To calculate 5 day

WMA calculates the weight of the first day as below:

Divide

the number of each day by sum of the number of days (15) and multiply it by the

value of the security (Price). For the last step, you should add all 5 weighted

values together (sum).

The sum of the number

of days = 1 + 2 + 3 + 4 + 5 = 15

5

day weighted moving average (WMA) = 2.33 + 4 + 8 + 12 + 16.66 = 43

Day

|

1

|

2

|

3

|

4

|

5

|

|

Value of the security

|

35

|

30

|

40

|

45

|

50

|

|

Weighting factor

|

||||||

1/15

|

2/15

|

3/15

|

4/15

|

5/15

|

||

Weighted value

|

||||||

2.33

|

4

|

8

|

12

|

16.66

|

||

Practical Ways to Use Moving Averages:

Moving averages can be used as a tool to:

Identifying a trend

Identifying Support

& Resistance levels Identifying price breakouts

Measuring price momentum

Moving Average can be

used easily as a tool to identify an uptrend market when

-

The

moving average is rising

-

The

price line tend to be above the moving average

- A shorter moving

average crossed the longer moving average

Normally,

a longer term map of the trend gives us much reliable perspective for the fact

of what's going on with the market. In order to identify a trend you should

take a look at a longer term chart like Weekly or Daily to see what the major

direction of the price is. Remember that this is very important to make sure

you are not on the wrong side of the market because a large number of big

losers easily had too many trades against the major trend. To identify the

longer term trend you can draw 200 SMA and 144 EMA onto the chart. Simply when

the 144 EMA is above the 200 SMA and at the same time the price is above the

200 SMA while both moving averages are diverging.

Now,

we have the big picture of the market and we at least know that a LONG trade is

not as risky as a SHORT trade. However, a short term trader needs a short term

signal to enter the market. A short term LONG signal would identify when:

-

The

144 EMA crossed the 200 SMA on 4H chart ( you can use 1H chart but it has more

noises than a 4H chart )

-

The

price must be above the 200 SMA

- The MAs is diverging

-

MAs and especially the 144 EMA must be in a

rising form (this is a visual experience and normally helps to avoid noises)

How to identify range

market by Moving Average:

As I

already explained, a trend market would be confirmed when two moving averages

diverge from each other. In other word, when a market is in an uptrend the

shorter moving average tends to diverge quickly from the longer moving average

and this makes the distance between two moving averages looks wider. This

phenomenon indicates that the momentum of the price is rising.

Otherwise,

when two moving averages are converging after they diverged once earlier (Where

we took the LONG trade), the price tends to pull back and this means the

momentum of the market is slowing, so the LONG trade is about to be invalid and

we must exit the market.

Furthermore,

two moving averages are on their way to cross over again but this time shorter

moving average cross the longer moving average in opposite direction

(Downward). The downward cross over of two moving averages gives us very

valuable information in which

the

momentum has slowed into levels that the price can not rely on it anymore. A

very weak momentum would means that the market is going to be lazy

(Consolidation) so we must avoid this situation and wait till a new clear

signal tell us what to do next.

Final Word:

There are many ways of using moving averages to identify

trading signals and normally different securities have different

characteristics so in some cases it may not be suitable to use aforementioned

interpretation of the moving average to analyze the chart as it may be better

to apply another periods for Moving Averages.

However,

most Common time periods for Moving averages whether using a single or couple

or triple moving averages are 9, 10, 13, 18, 20 and 21 for short term scale,

40, 55 and 89 for medium term scale and 100, 144, 200 for long term scale. The

time periods that better suite your needs can be obtained by comparing

different time periods ( common) based on the length of the cycle in which the

security repeat itself or the number of days that you may consider them as the

most referable data in your security's history. I suggest consulting an expert

instead of doing a lot of work.

0 Response to "A Practical Guide to Technical Indicators; Moving Averages"

Post a Comment